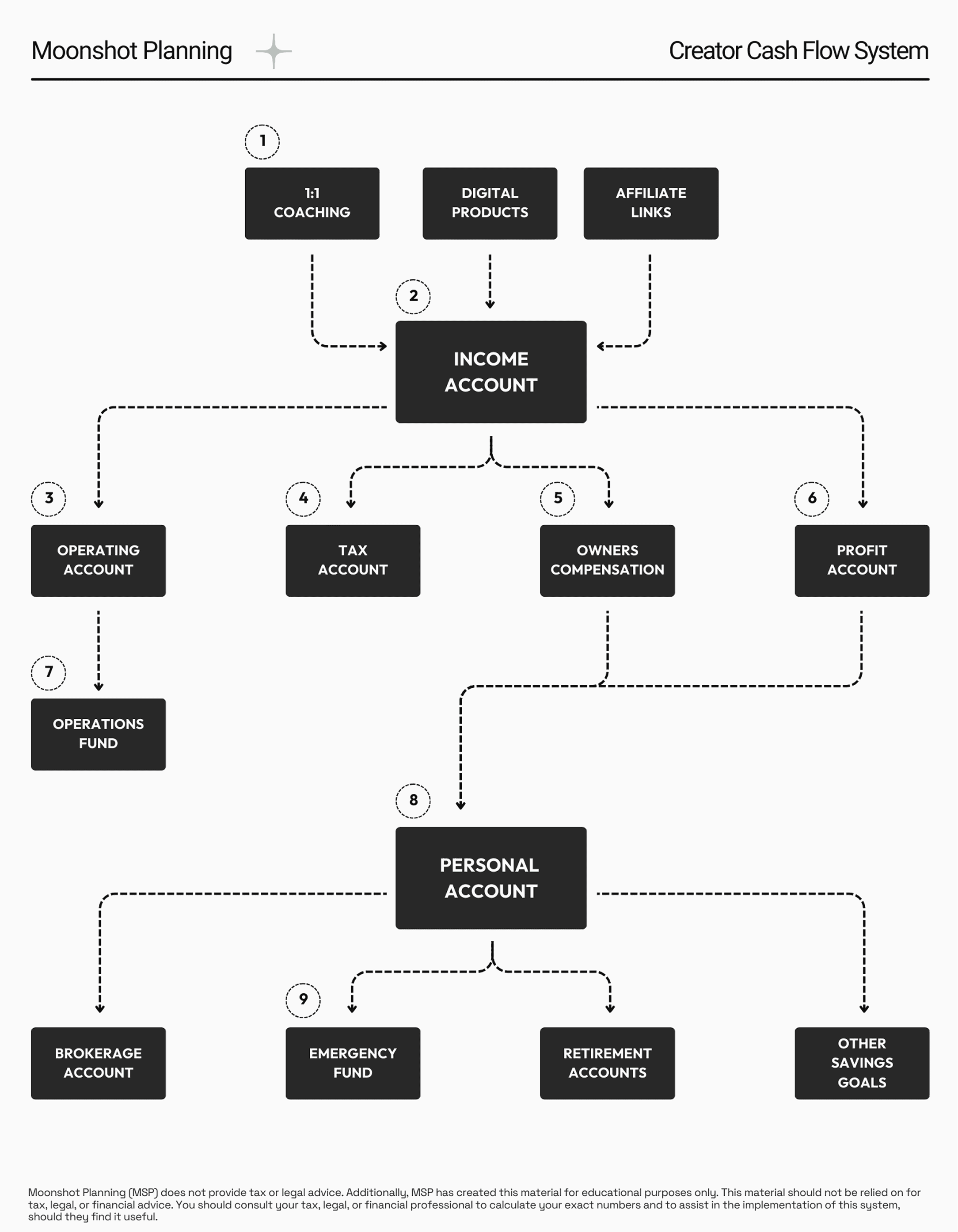

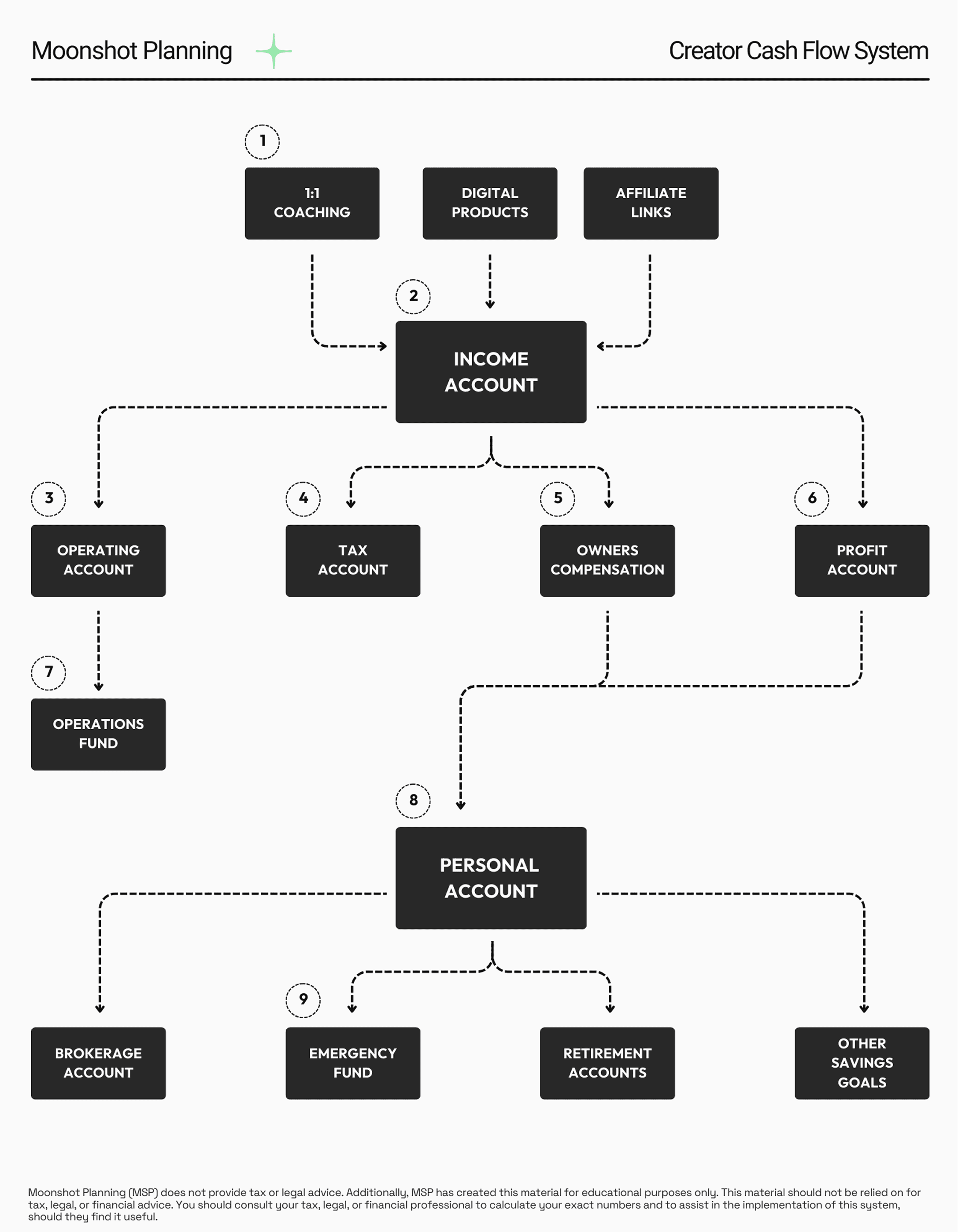

CFP® for Creators

From Chaotic Creator Income to Predictable Financial Freedom

100K+ followers, brand deals flowing in, but behind the scenes? Tax panic, inconsistent income, and zero retirement plan. We fix that.

Creator Challenges

What is Keeping

Creators Up at Night

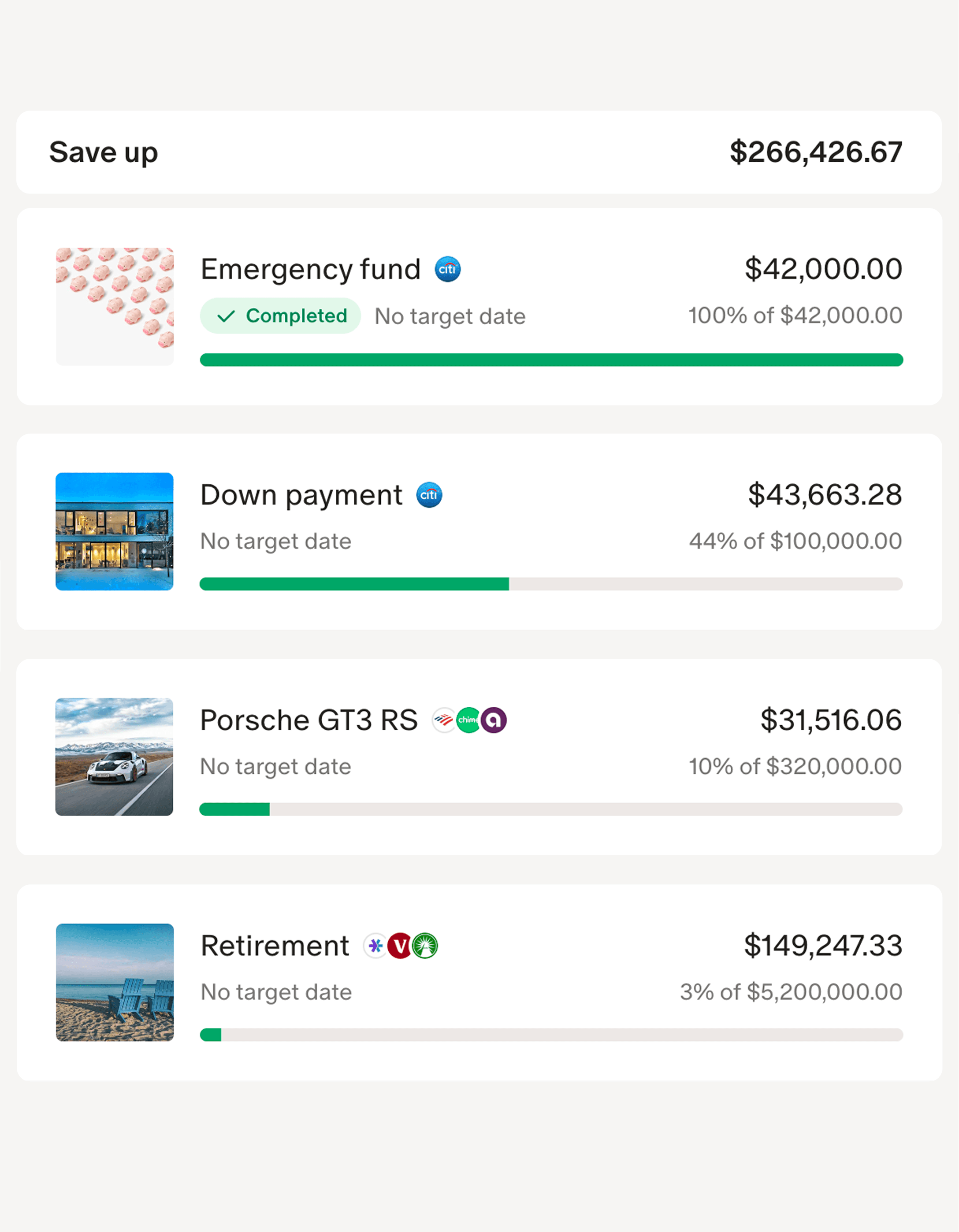

You're pulling in $150K+ from brand deals, AdSense, sponsorships, or other means. But $40K is sitting in savings, because you don't know what to do with it. Your tax bill terrifies you. And your W-2 friends with their 401(k) matches make you feel like you're falling behind.

What We Offer

Solving Financial Problems

for Creators Like You

Common Financial Questions

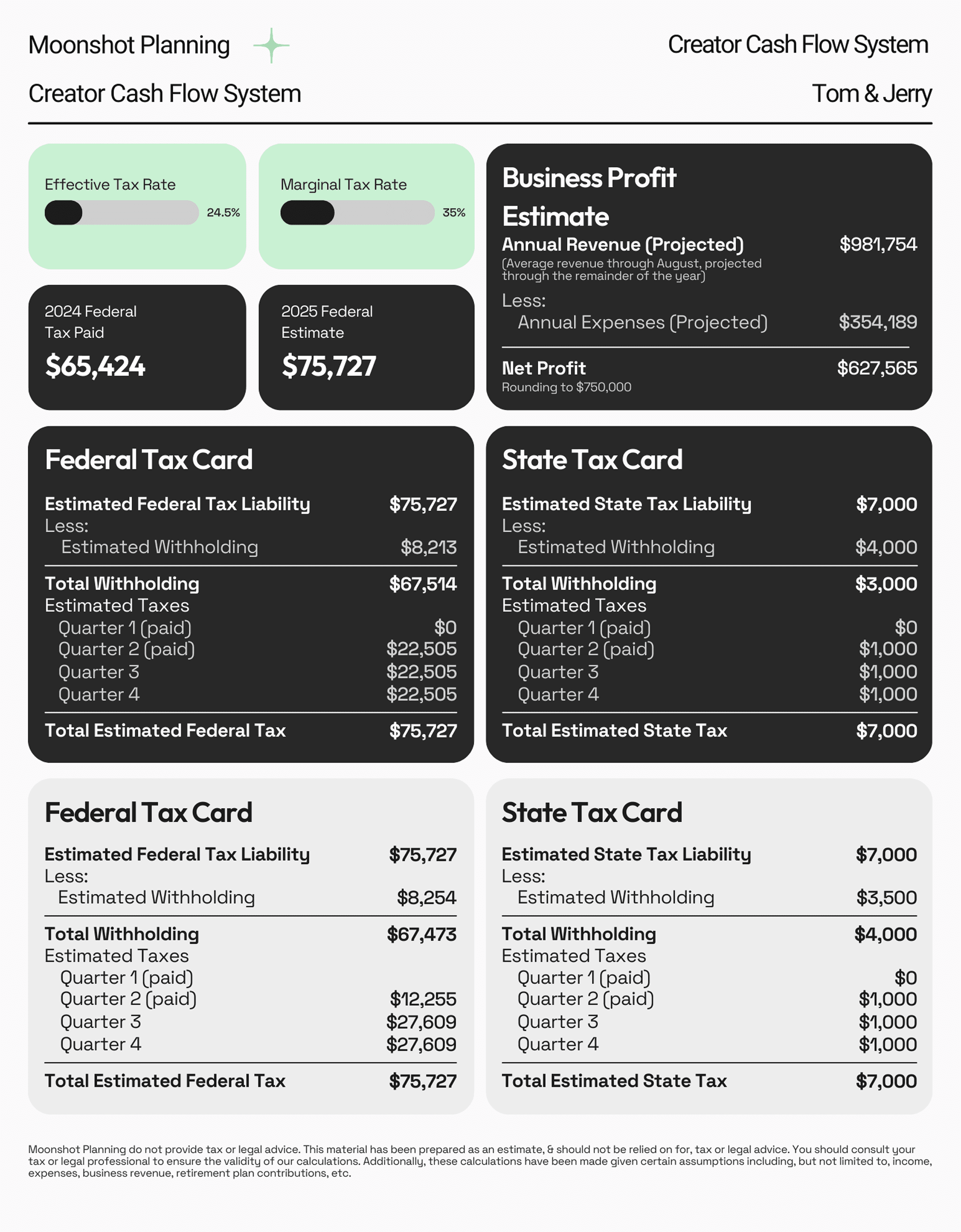

How much am I supposed to set aside for taxes?

Ongoing Planning Yes, you do sign a 12-month contract that transitions to a month-to-month contract after the first 12 months.

How do I plan for my inconsistent income?

Flexible Options You're welcome to switch plans annually. Between annual reviews, changes are handled on a case-by-case basis. After all, we're here to improve your financial position and confidence, not harm it.

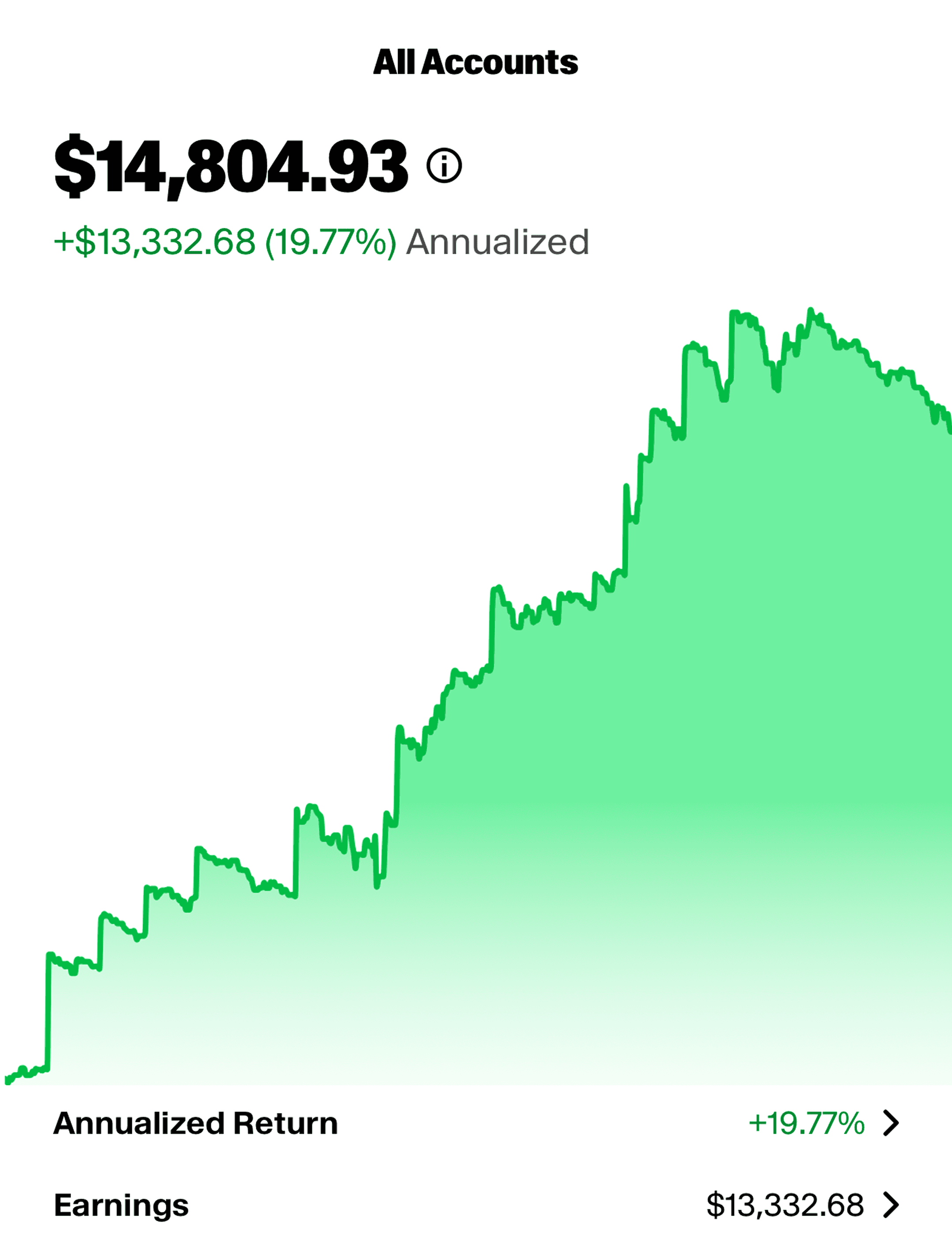

I know I need to invest for my retirement, but what are my options?

Human First Approach This isn't a cut-and-dried contract. We're human, you're human, and sometimes life just happens. With that said, we'll work with you when it comes to this. I said it once, and I'll say it again: after all, we're here to improve your financial position and confidence, not harm it. Most new creators start around $200-$300 per month. Six-figure businesses are typically $500-$700 per month. The exact fee depends on complexity, but you can learn more on our pricing page.

What can I actually deduct on my tax return?

We Help You Save Not File No—we do tax planning (strategies to minimize what you owe). We work alongside your CPA or can refer you to one.

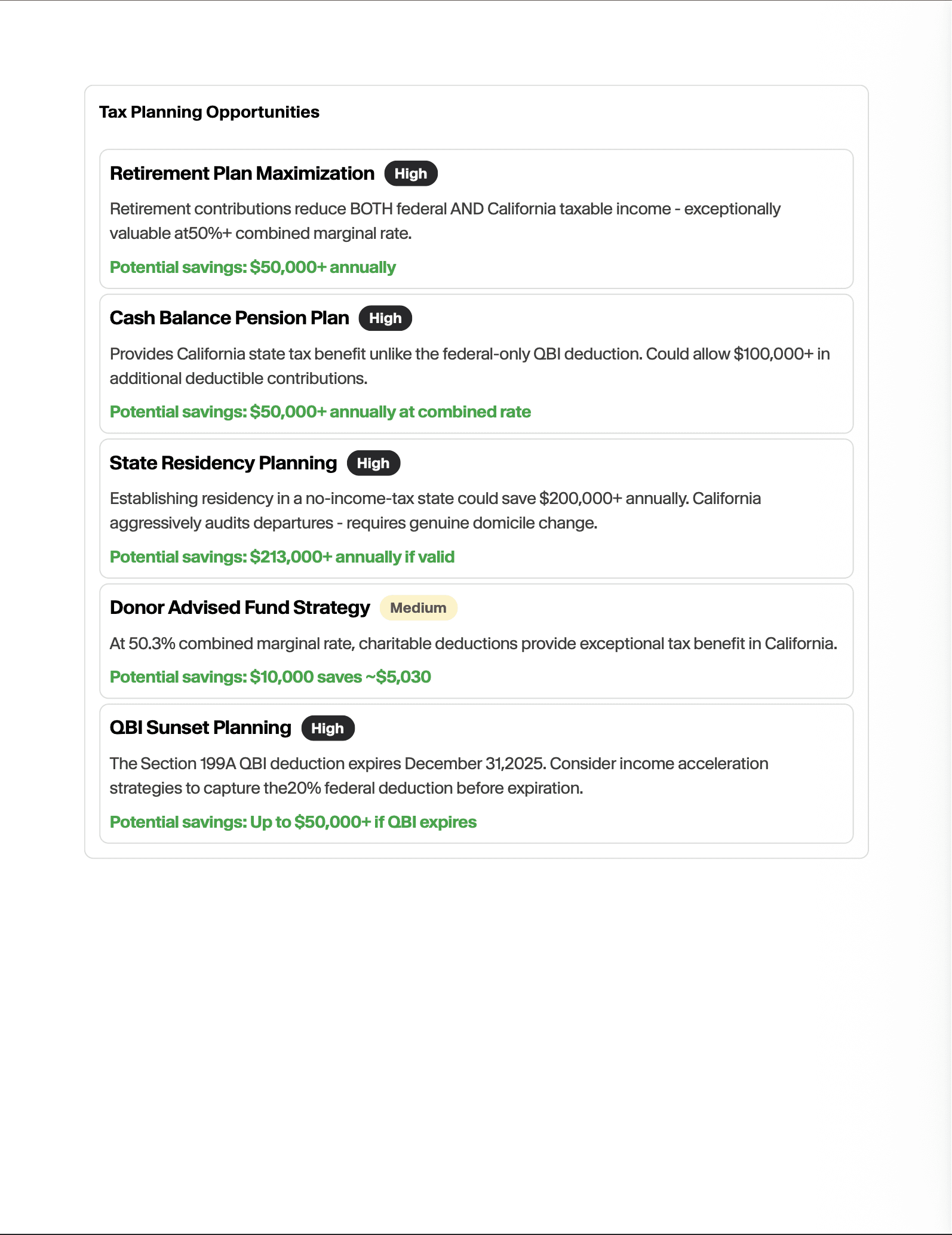

What are the best ways to save money on taxes as a creator?

Fee-Only Approach No. Your monthly fee covers everything listed in your plan. Investment accounts have minimal fund fees (industry standard), but no additional advisor fees.